The Hearthfire Income Portfolio

A Private Equity Self Storage Investment Opportunity

to Accelerate Your Wealth Journey

Status: OPEN - 97% SOLD OUT - Limited Shares Available

a SEC Regulation D 506(b) Open to Accredited & qualified Sophisticated Investors

TIMESTAMPS

1. Why invest in self-storage (2:50)

2. Hearthfire acquisition criteria & target markets (9:07)

3. Why is now a good time to invest in alternative investments? (10:35)

4. Hearthfire portfolio, purpose and history of strong, consistent growth (18:00)

5. Hearthfire skin in the game, family and team investments (24:48)

6. Core team and tech stack (28:22)

7. Hearthfire Income Portfolio Opportunity - overview, timeline and why it is a unique deal (34:18)

8. Portfolio property snapshots (40:00)

9. Offering terms and financial analysis (43:55)

10. Performance updates; market update; construction and financing update (47:44)

Investment Overview

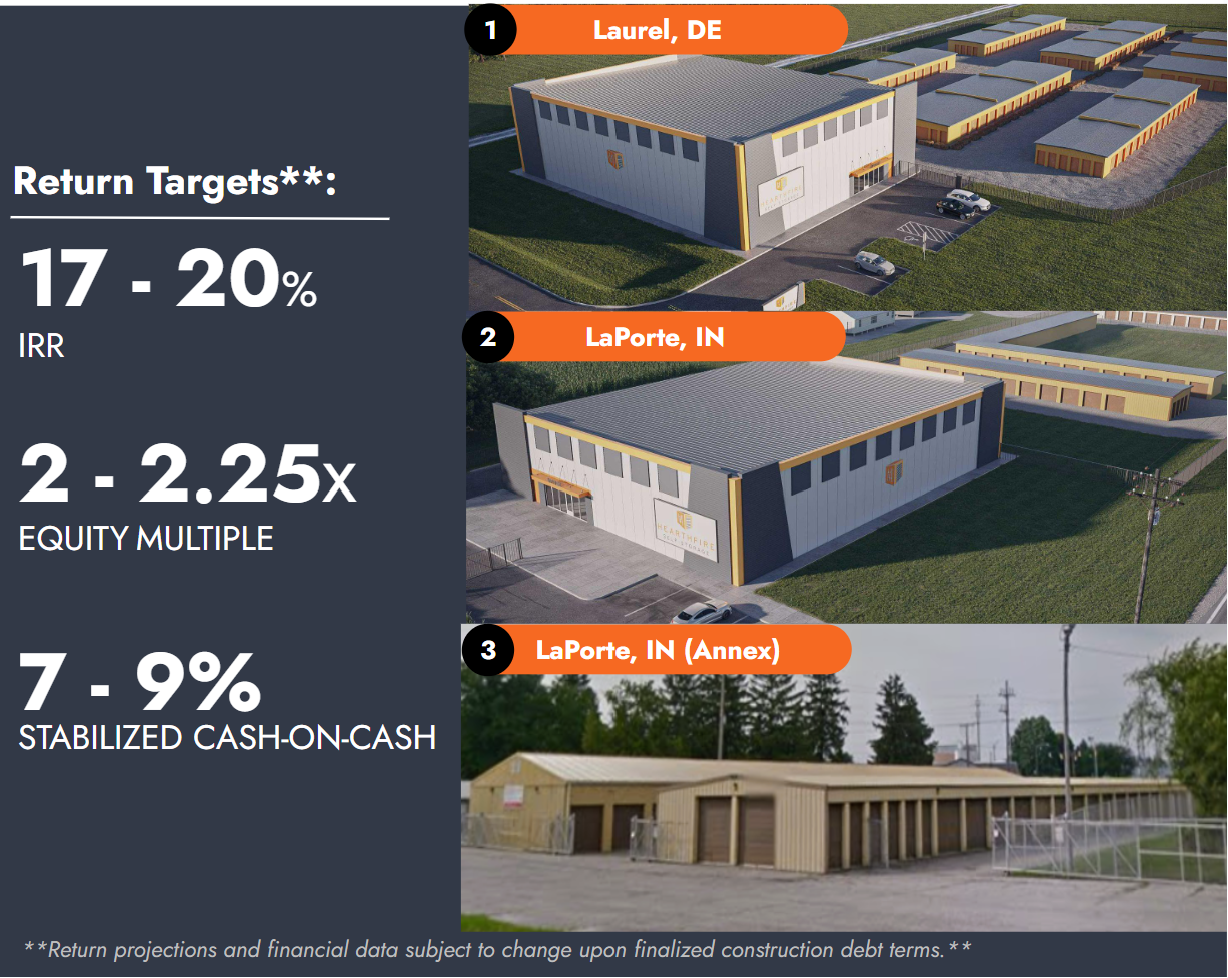

The Hearthfire Income Portfolio is an investment in three distinct properties located in Indiana and Delaware:

two with Class-A climate control expansions, and the third significantly undermanaged.

Combined return targets ** of:

17-20% IRR - 2-2.25x EM - 7-9% CoC.

** Return projections and financial data subject to change as construction debt terms are finalized.**

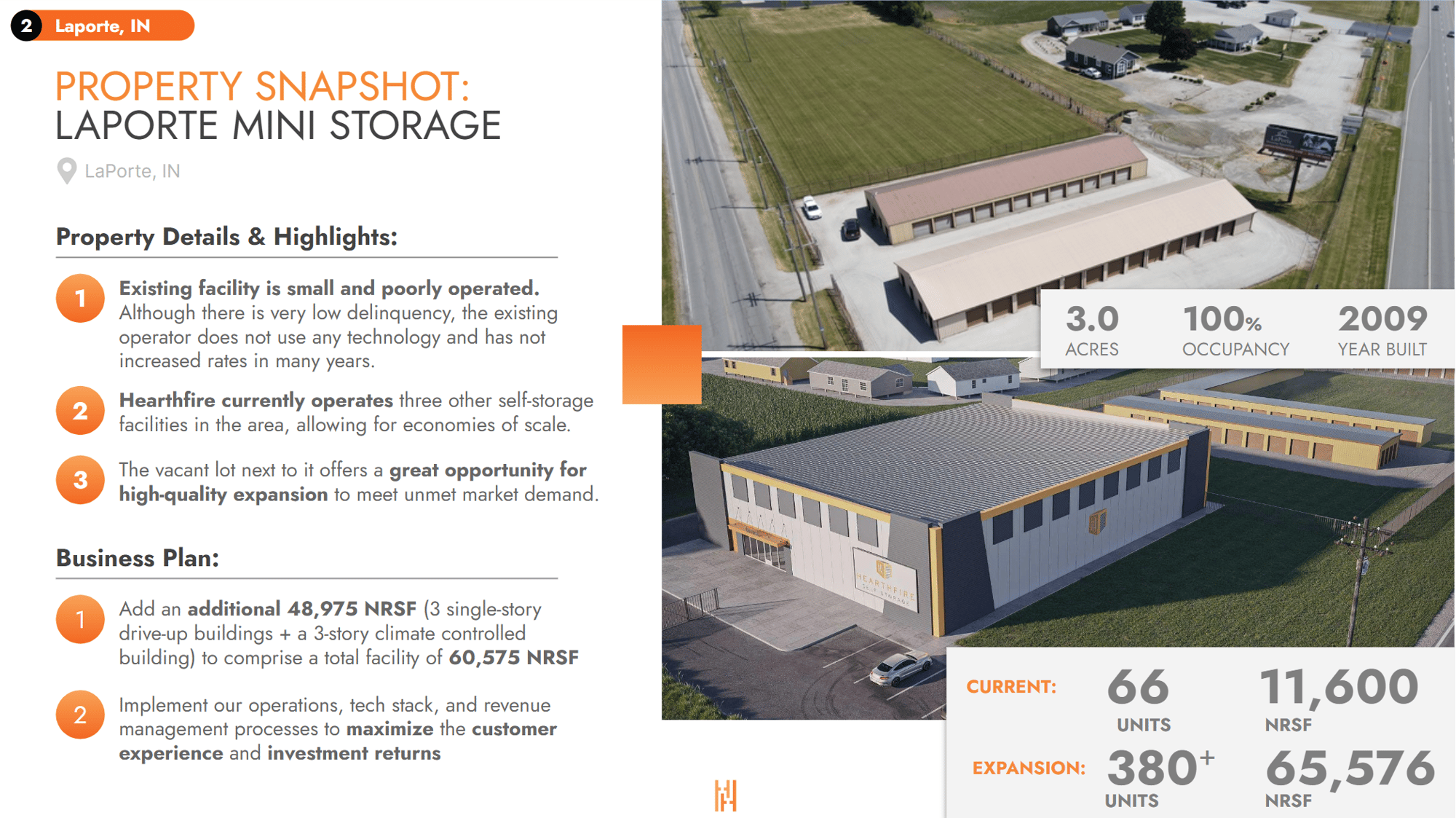

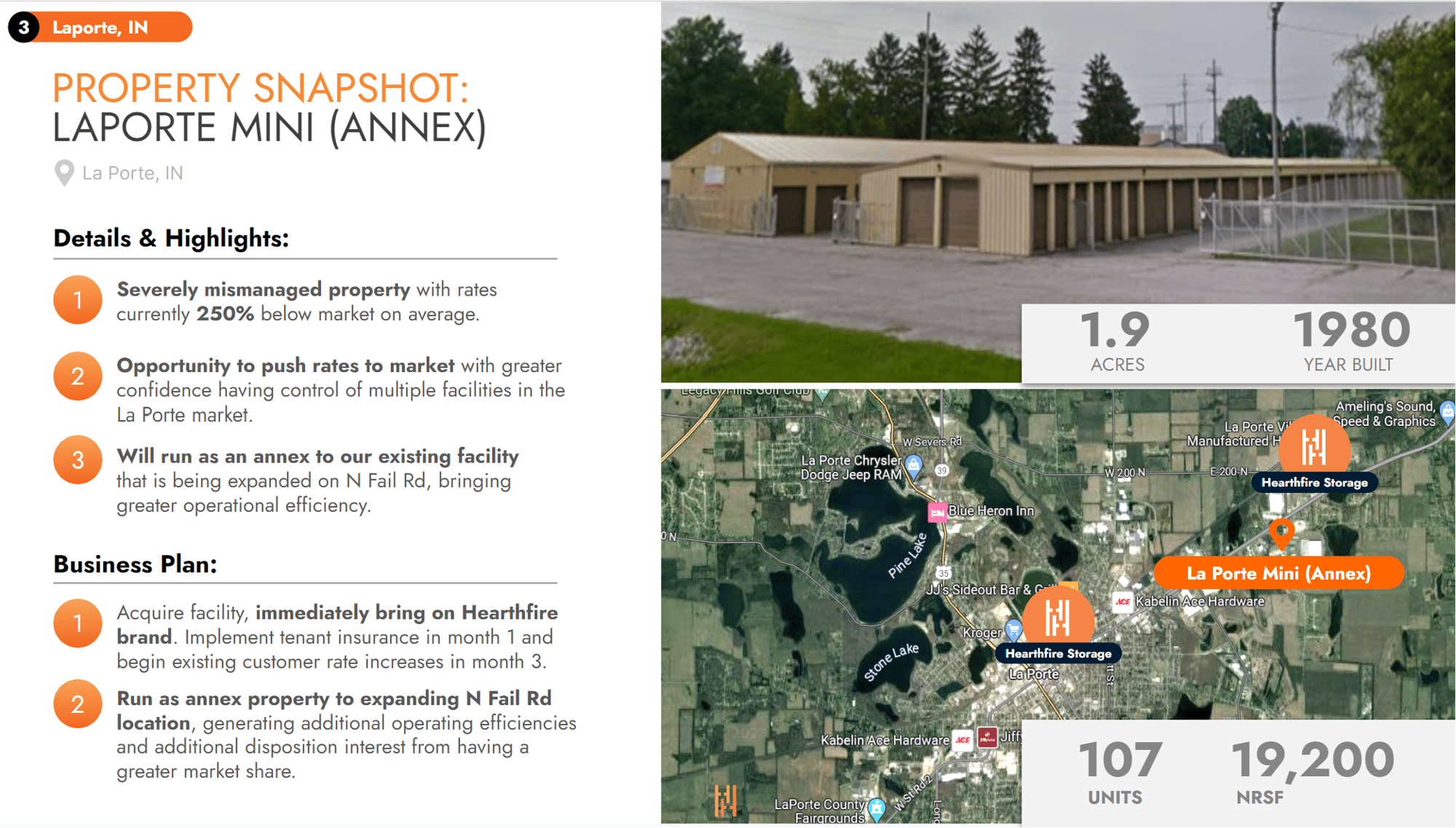

Property Overviews

Hearthfire will drive immediate value at these existing properties through improved operations,

and significantly increase value through expansion potential.

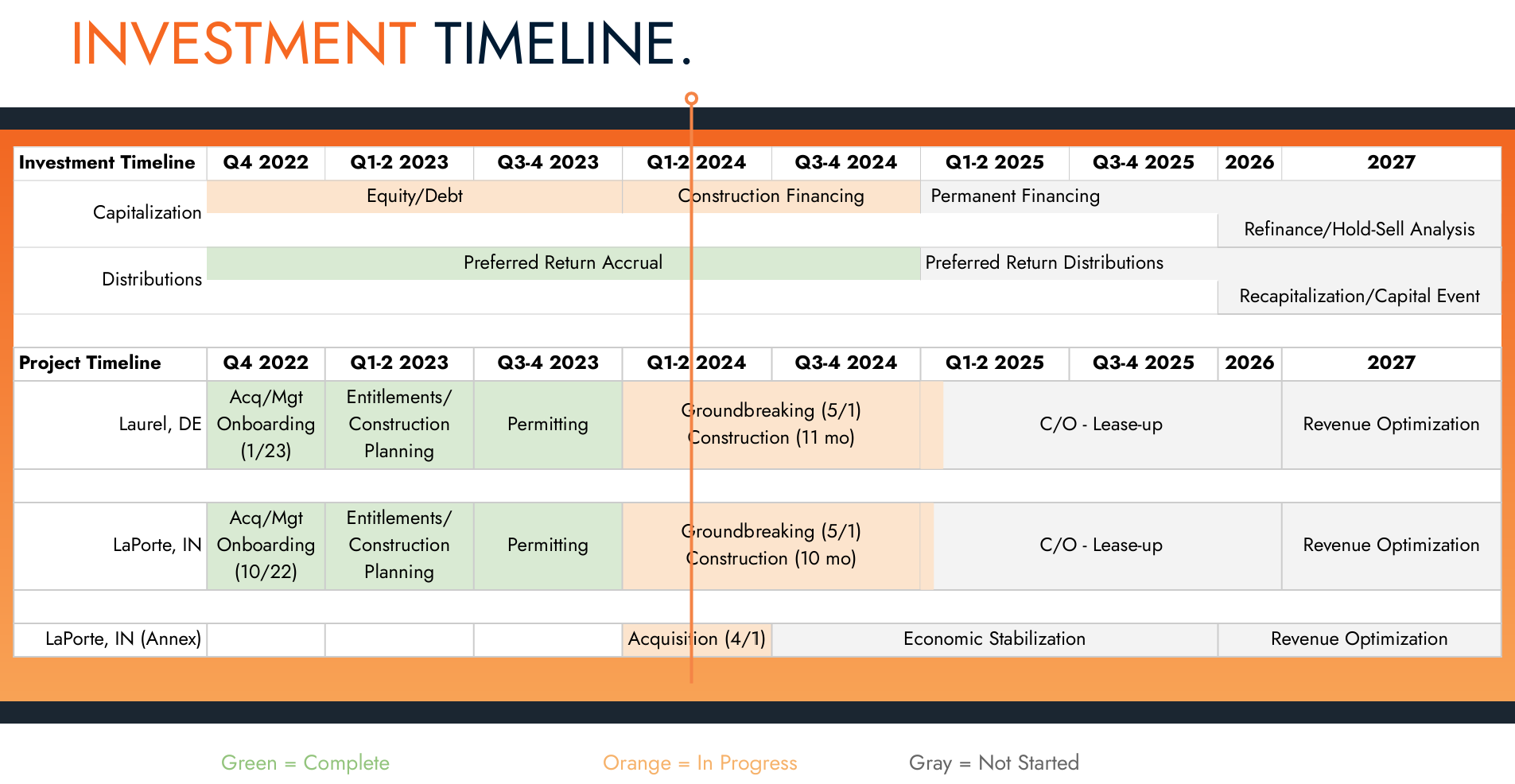

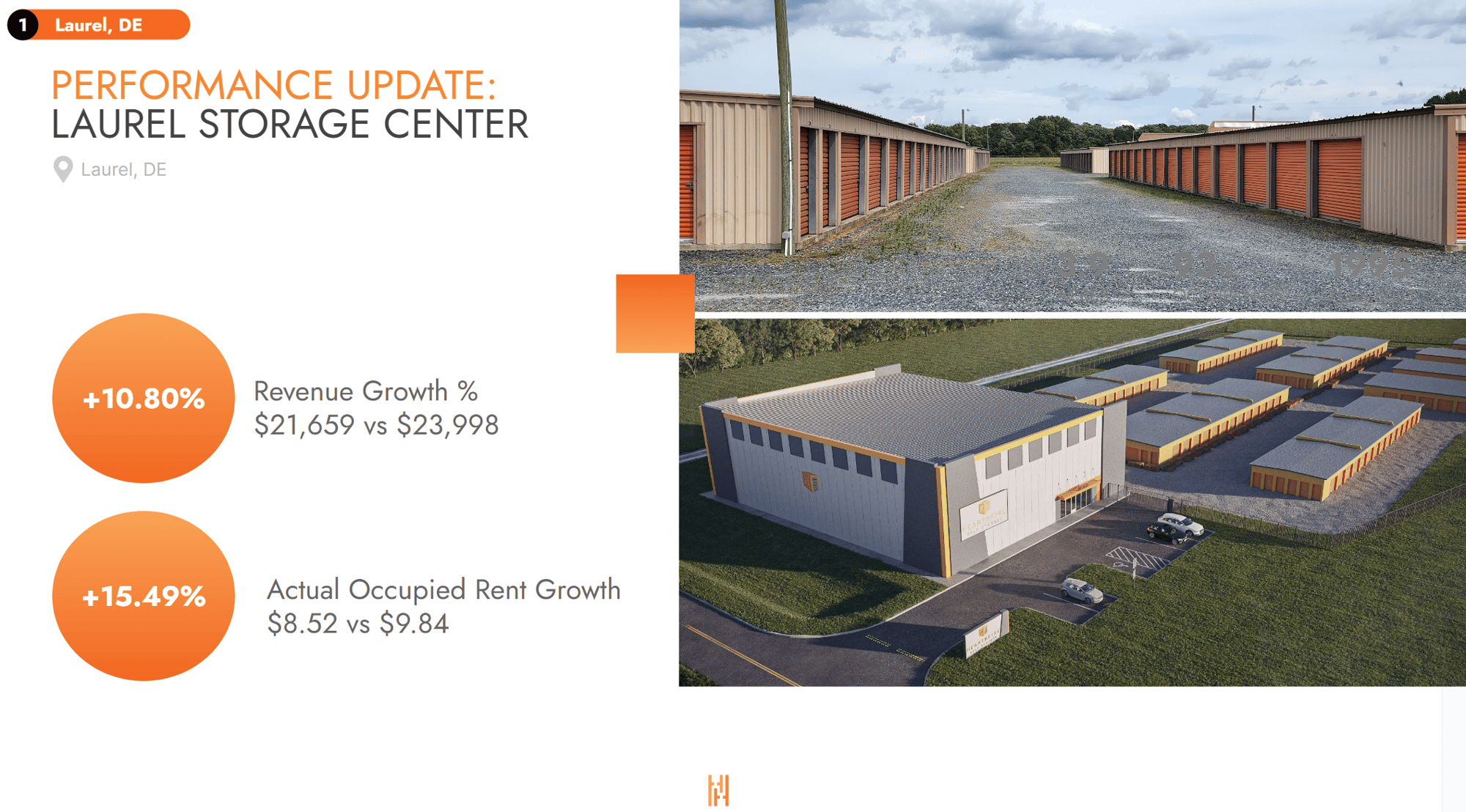

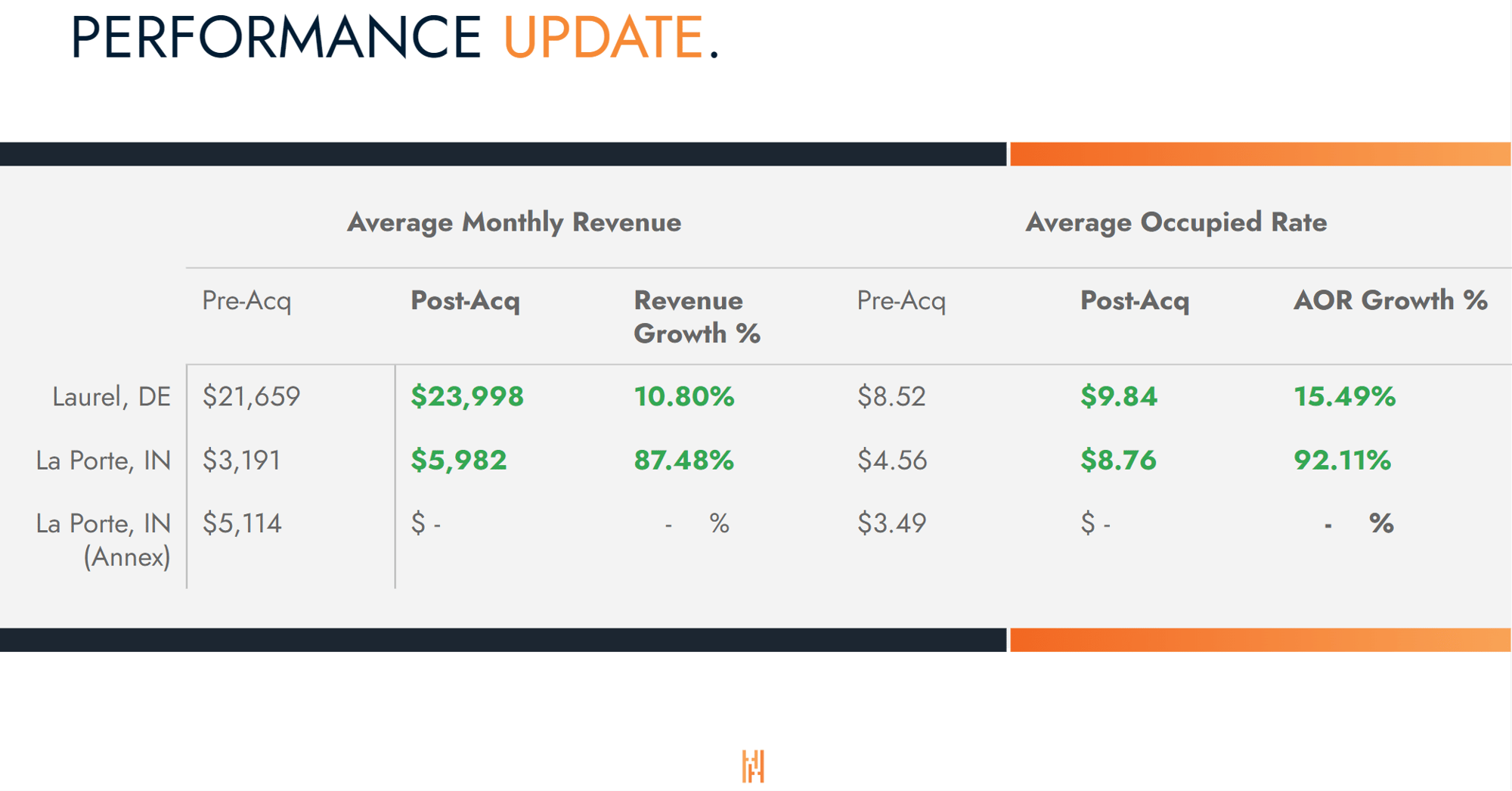

Property Performance Update

Since the Hearthfire Team has owned and operated two of these locations for 12 months, we have active performance data to show the impact of implementing improved business operations. This bodes well for the continued value we will drive with the latest

off-market acquisition of the third location (LaPorte, IN Annex).

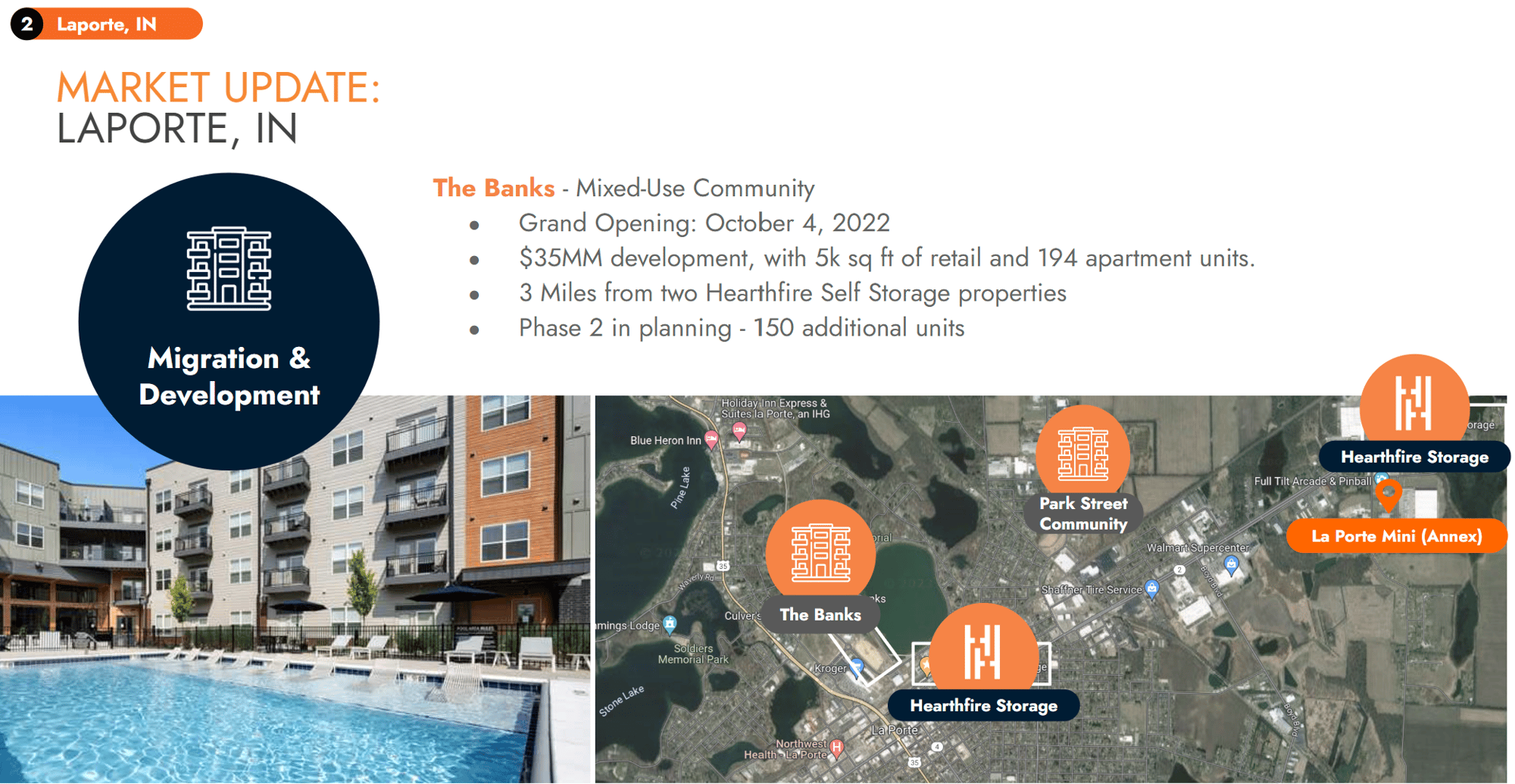

Market Overview and Update

The Class-A expansions will provide much-needed storage to these growing areas.

See below for more information on market demographics and growth trends.

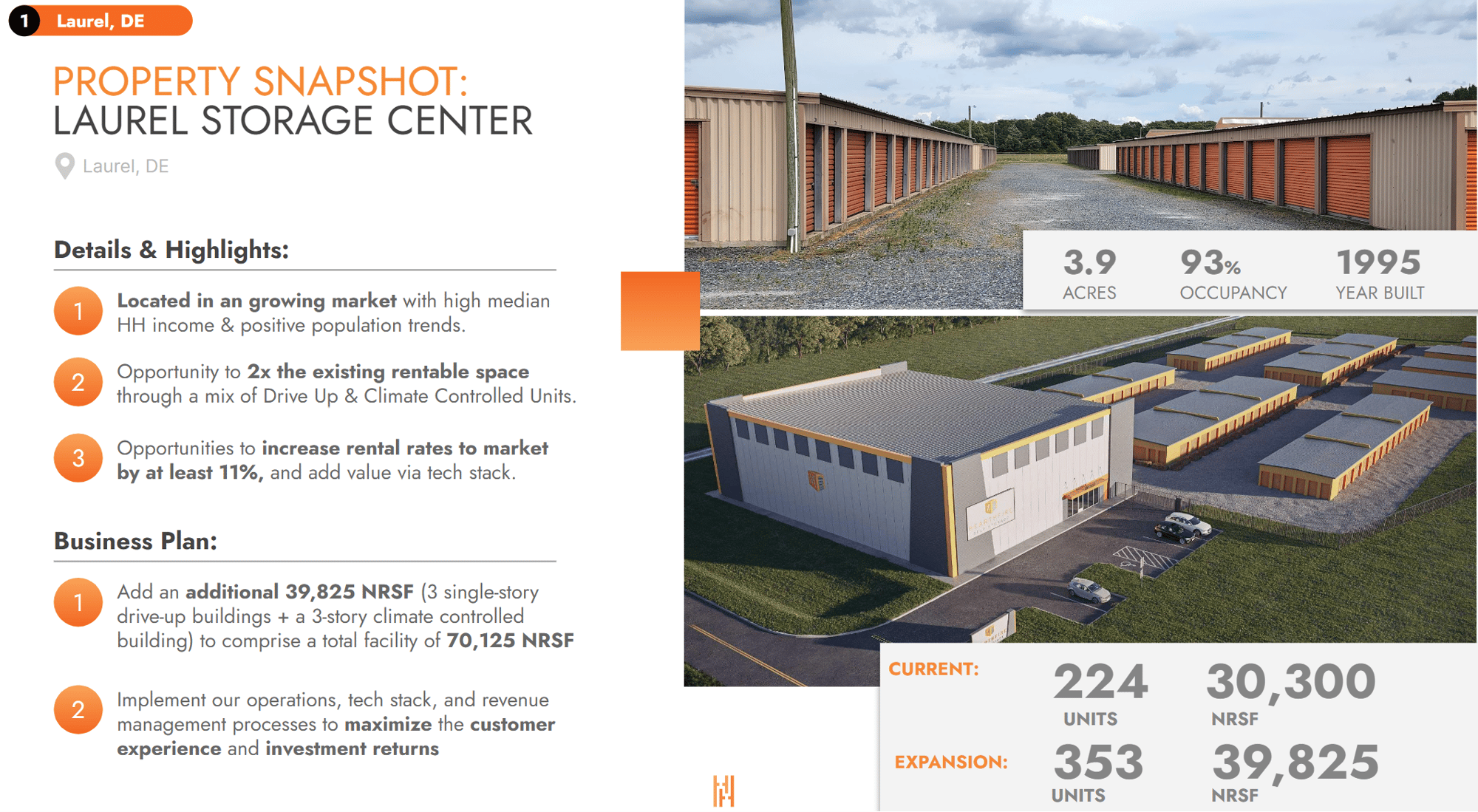

Expansion Plans Taking Shape in LaPorte and Laurel

The architect renderings below illustrate the expansion project about to get underway at the two properties held by the Hearthfire Income Portfolio. These modern, efficient additions to each project will expand capacity to meet the growing demand for self storage in two markets where we're strategically positioned to capitalize on growth.

Laporte, Indiana: Adding 65,765 net retail square feet (NRSF) including 44,625 Climate Controlled plus 21,140 NRSF for a total of 77,176 NRSF post expansion

Laporte, Indiana: Adding 65,765 net retail square feet (NRSF) including 44,625 Climate Controlled plus 21,140 NRSF for a total of 77,176 NRSF post expansion

Laporte, Indiana: Adding 65,765 net retail square feet (NRSF) including 44,625 Climate Controlled plus 21,140 NRSF for a total of 77,176 NRSF post expansion

Laurel, Delaware: Adding 3 single-story drive-up buildings totaling 10,975 NRSF plus a 3-story Climate Controlled building totaling 28,025 NRSF for a total of 69,300 NRSF post expansion

Laurel, Delaware: Adding 3 single-story drive-up buildings totaling 10,975 NRSF plus a 3-story Climate Controlled building totaling 28,025 NRSF for a total of 69,300 NRSF post expansion

Laurel, Delaware: Adding 3 single-story drive-up buildings totaling 10,975 NRSF plus a 3-story Climate Controlled building totaling 28,025 NRSF for a total of 69,300 NRSF post expansion

Construction Updates and Progress

The Hearthfire team has owned these properties since January of 2023. The efforts to date have been getting entitlements for the expansions approved while navigating the capital markets to secure the best debt terms.

We are pleased to report that we are fully entitled and permitted on both projects, with construction already begun.

We are also in the final stretch of securing construction financing, so the opportunity is strongest for new investors.

Not only are new investors able to join this investment at the same call spaces as early investors, but the individual return projection is higher due to a shorter duration in the deal.

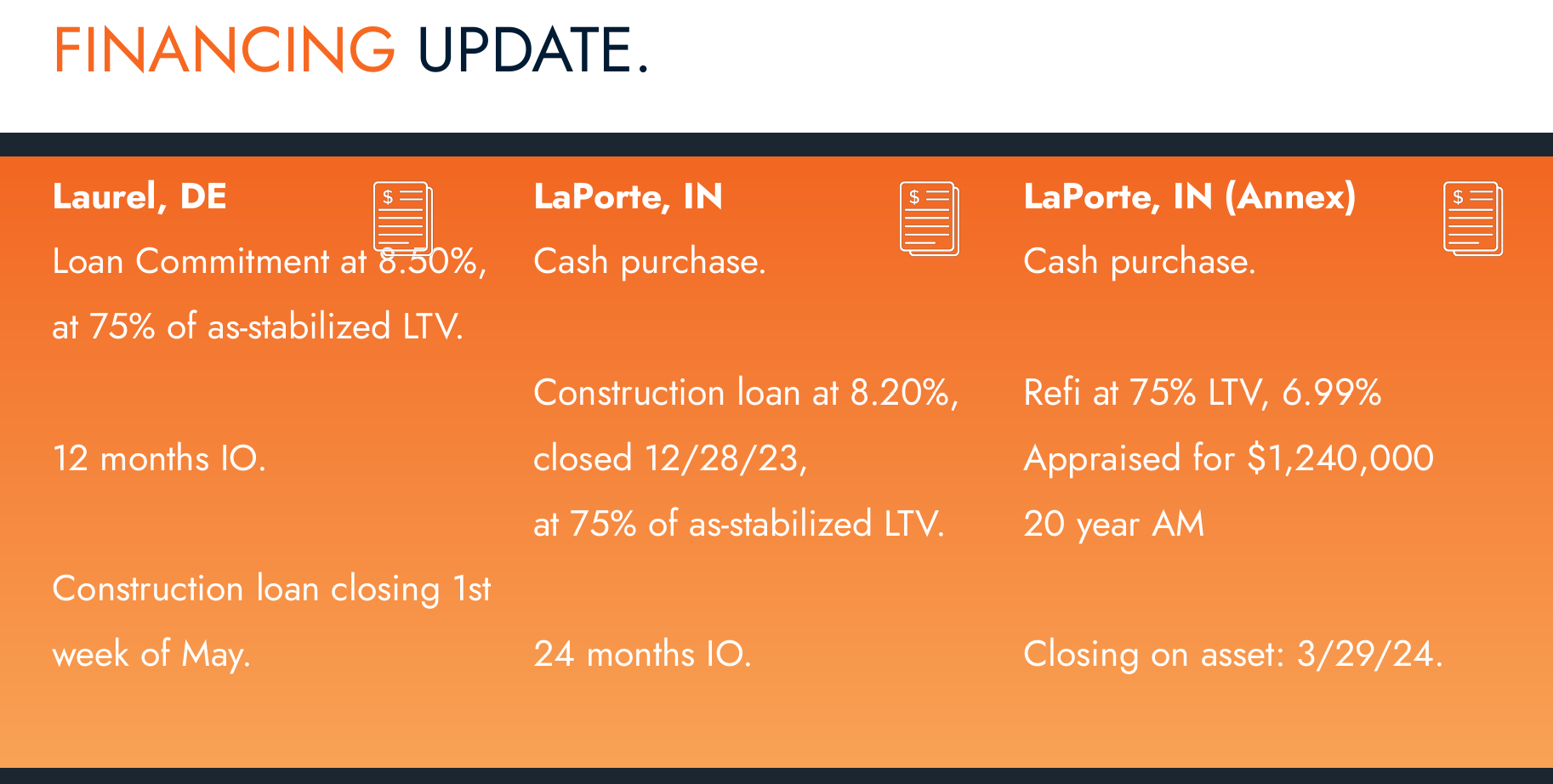

Favorable Debt Terms

Hearthfire remains focused on minimizing risk within the Income Portfolio while concurrently achieving strong returns for our investors. One component of this strategy revolves around securing attractive debt financing. To that end, we are very pleased to share the financing updates below. These speaks to the strength of Hearthfire and our ability to transact at better-than-market terms in a very choppy, unpredictable lending environment. These loans will be accretive to the project and in line with our risk minimization and return-seeking strategy.

The Hearthfire Story

Hearthfire started as a personal investment endeavor by founders Sergio and Corinn Altomare.

In the early days, their investments performed very well. But as thrilled as they were with the excellent financial returns they were experiencing, Sergio and Corinn soon realized that by sharing their real estate investment model with others they could deliver even more impact.

Since then, nearly two hundred people have joined the Hearthfire journey. Those who have been with Hearthfire since the beginning have seen their initial investment grow by 500%+.

Now, you're invited to join the Hearthfire Community.

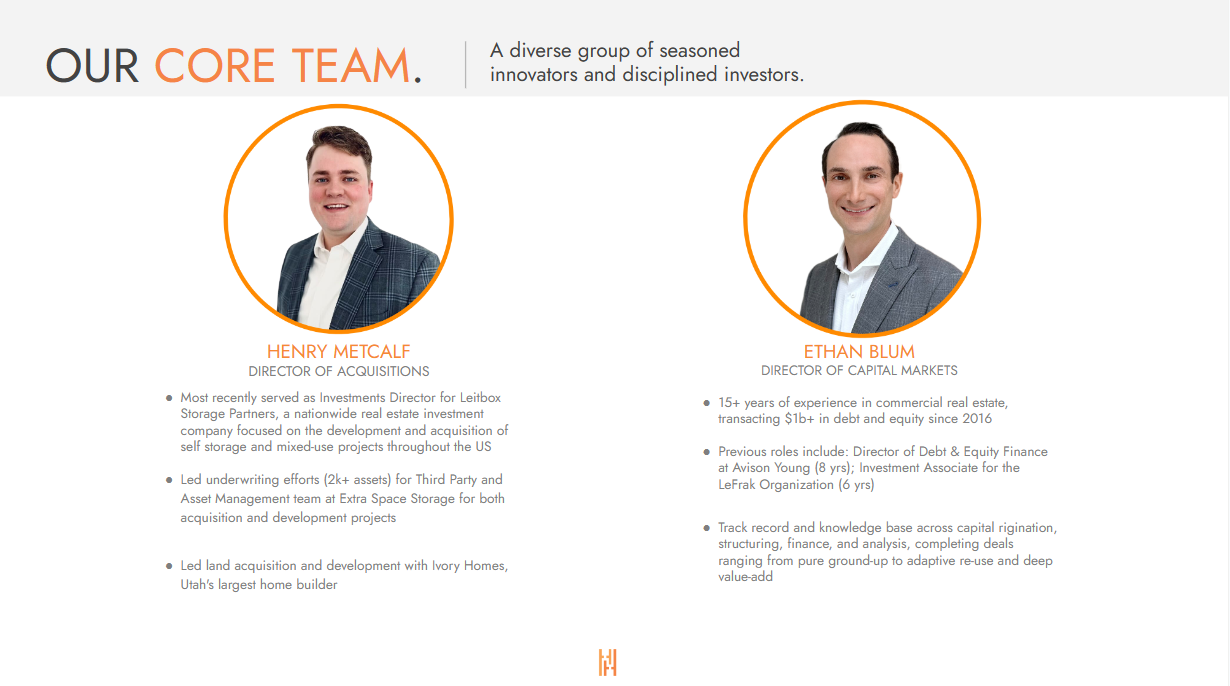

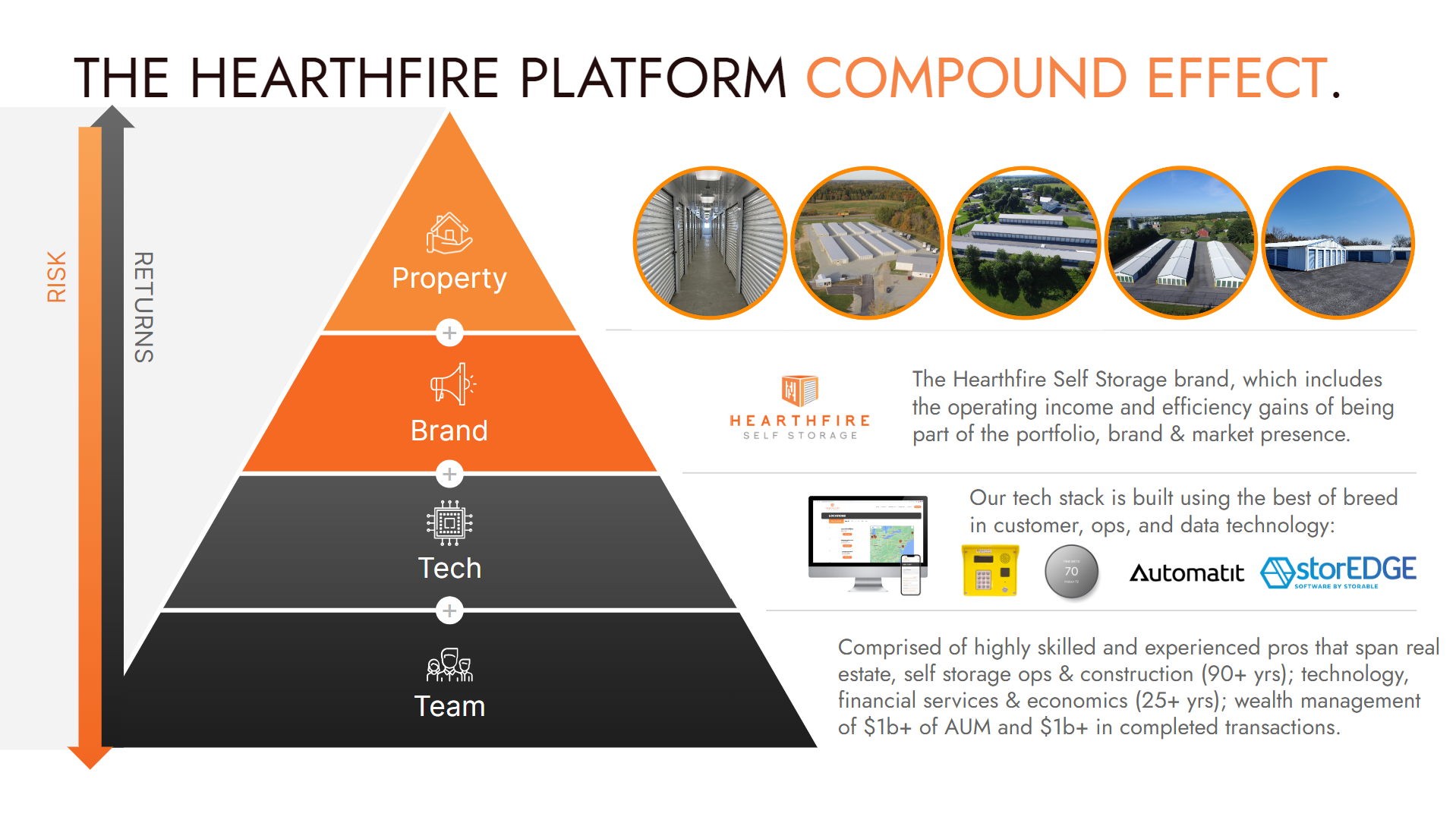

The Hearthfire investment model combines a team of seasoned private investment professionals whose experiences span three economic cycles since 2004. Together, they deliver:

A Disciplined Investment Strategy focused on long-term growth assets in promising markets, with portfolio construction and risk management philosophies that seek "speed to stabilization."

A proven and winning Track Record, with total full lifecycle returns of 33% net levered IRR and 2.3X equity multiple.

An independent and comprehensive platform, promising top-tier investor transparency and communications direct from company leadership using up-to-the-minute technology.

The Hearthfire Team

Hearthfire brings together decades of experience across every dimension of real estate investing and operations. Together, these seasoned real estate and investment professionals strive to deliver the investment results and attentive personal service discerning investors expect and deserve.